Cycle Bottom Report

Obsessed with market cycles

Cycle Bottom Report

Cycle Bottom Report

It's time again to look at $ADBE as it declines to Yearly Cycle Low (YCL) The initial YCL was printed at the end of 2022. Following, we've seen a flat weekly cycle 32 weeks longs. This was in fact a yearly backtest of the low. After

Four Hour Cycle Report

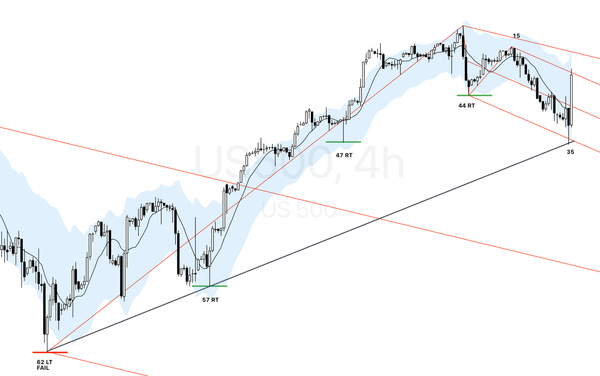

June 5, 2024 (week 23) For Black Belt Tier Subscribers Mid week 4-hour cycle update looking for confirmations of cycle bottoms & projections to the next expected 4-hour cycle low. $US500 - Four-Hour Cycle Overview Current Cycle Position: * $US500 is moving higher to HCH expected on Thursday before a small

Blog

Blog

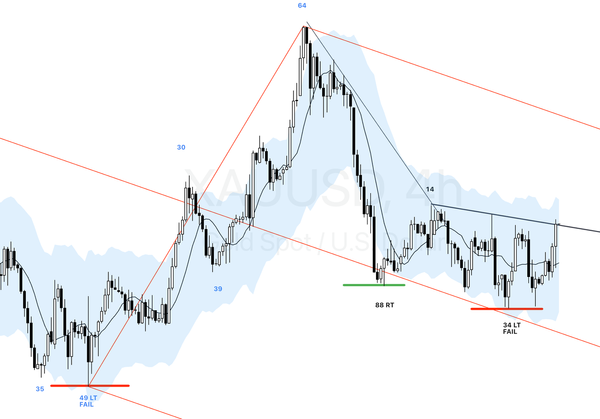

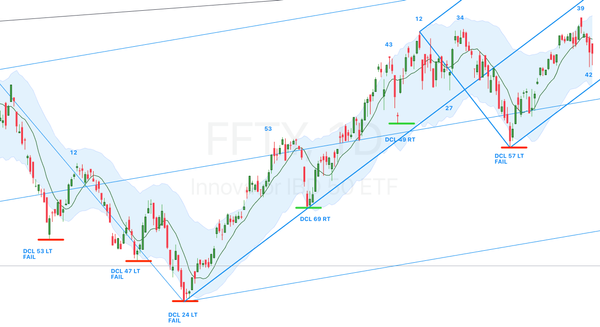

Let’s unpack how we spot a confirmed Yearly Cycle Low (YCL) using $FFTY as our real-world example. It's like detective work, but for market cycles!🕵️♂️ What Signals a Confirmed YCL? 1. Monthly Swing Low 2. Close above a cycle declining trendline 3. Close above 10 month MA

Four Hour Cycle Report

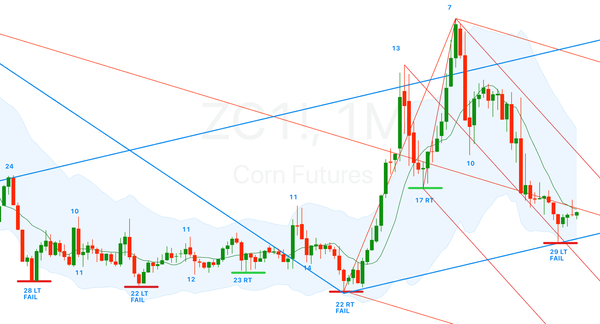

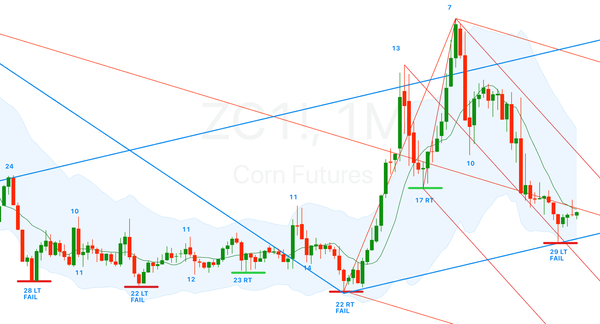

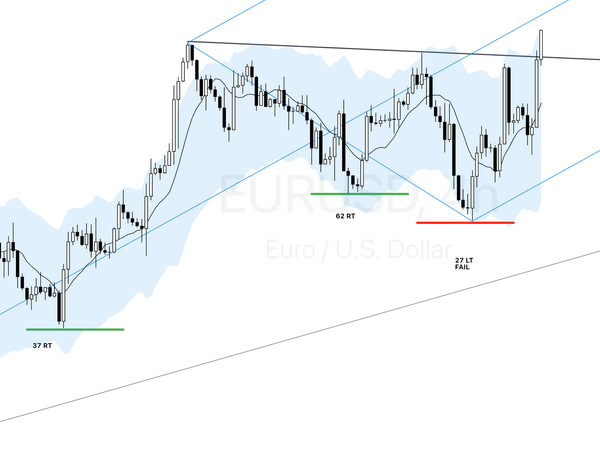

June 3, 2024 (week 23) For Black Belt Tier Subscribers A follow-up post t0 the 4-hour cycle update video from over the weekend. Some clarity over $EURUSD 4-hour cycle & early DCL. $US500 - Four-Hour Cycle Overview Current Cycle Position: * Cycle low was printed on day 35 which is now

Four Hour Cycle Report

Newsletter

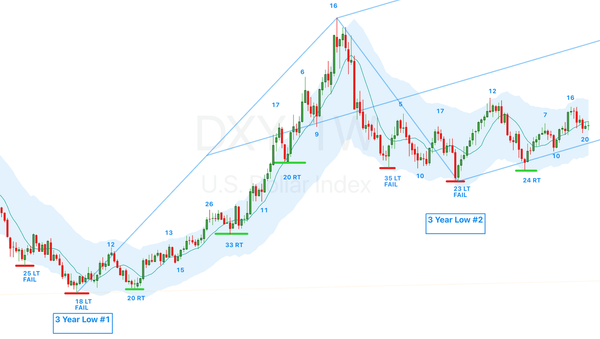

Welcome back to the Weekly Cycle Report for Week 23 of 2024. This week, we'll update you on the markets as we might have seen a few HCL prints. We've also got our eyes on a monthly swing high for $USOIL. Key Highlights * $USD: Continuing decline

Blog

Four Hour Cycle Report

Blog

Let's dive into Applied Materials, Inc. ($AMAT) and its observed long weekly cycle. Since 2020, $AMAT has been showing a consistent cycle, hitting its cycle lows about every 54 weeks. We can think of this as a yearly cycle. The Cycle The $AMAT yearly cycle can be dissected

Tools

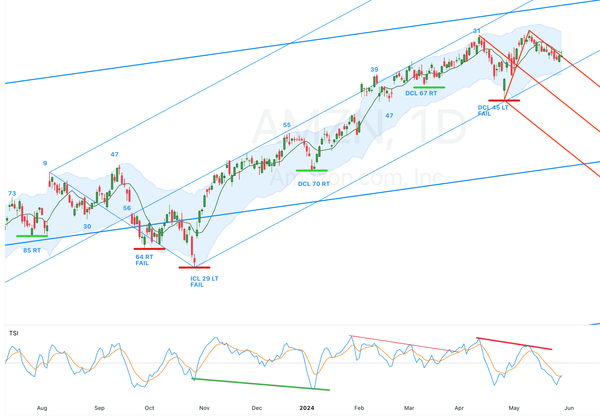

Introduction Divergences are pivotal in spotting potential reversals at cycle bottoms and tops. By comparing price action with indicators, investors gain crucial insights and early signals for shifts in cycle structure. Commonly, we work True Strength Index (TSI) with settings at 7, 4, 7, although similar results can be achieved