Cycle Swings

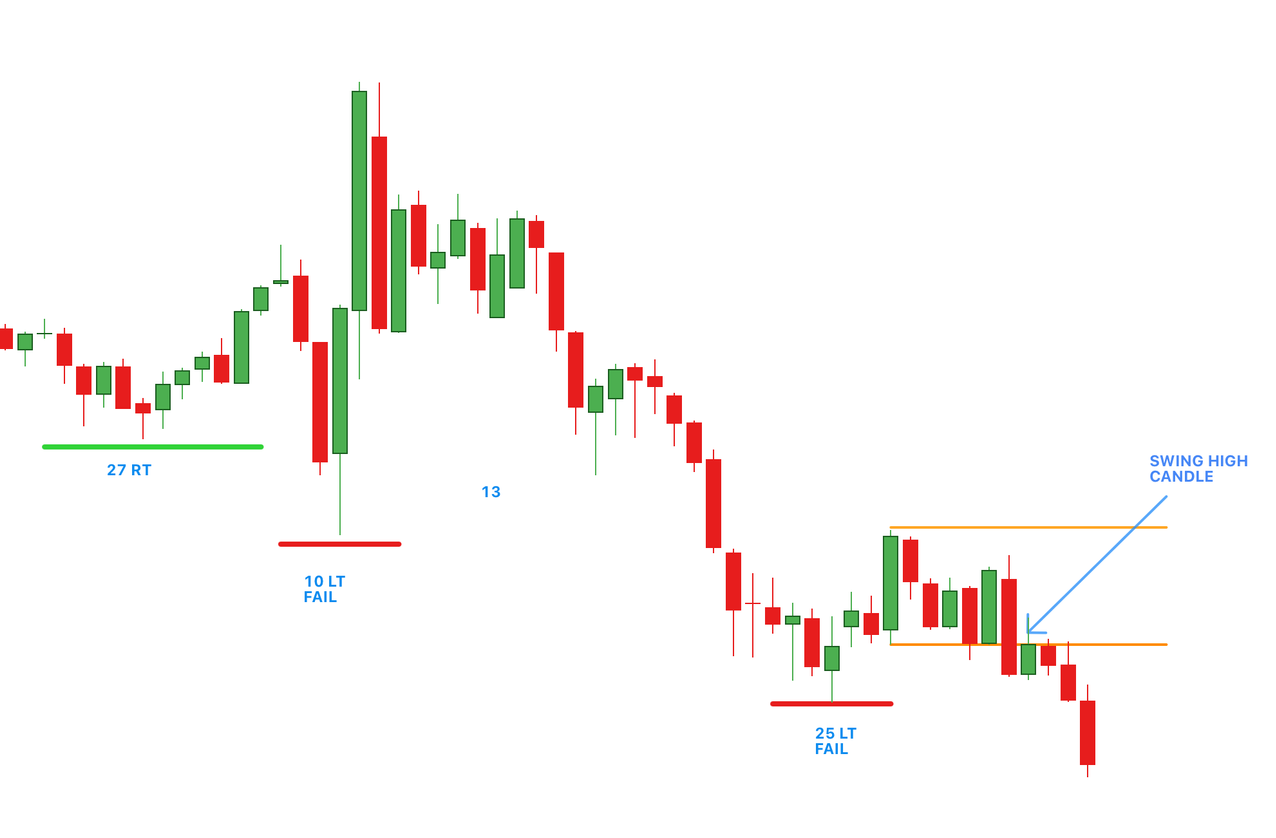

Swing High

Definition: A swing high is formed when the price reaches a new high within a specific period and then subsequently falls below the low of the candle on which the high occurred.

With the price closing below the low of the week, swing high was printed at the highlighted candle. Important to note, the previous attempts to print a swing high did not materialize as the price did not close below the low of the weekly candle. Only 6 candles later, the price managed to print a swing high.

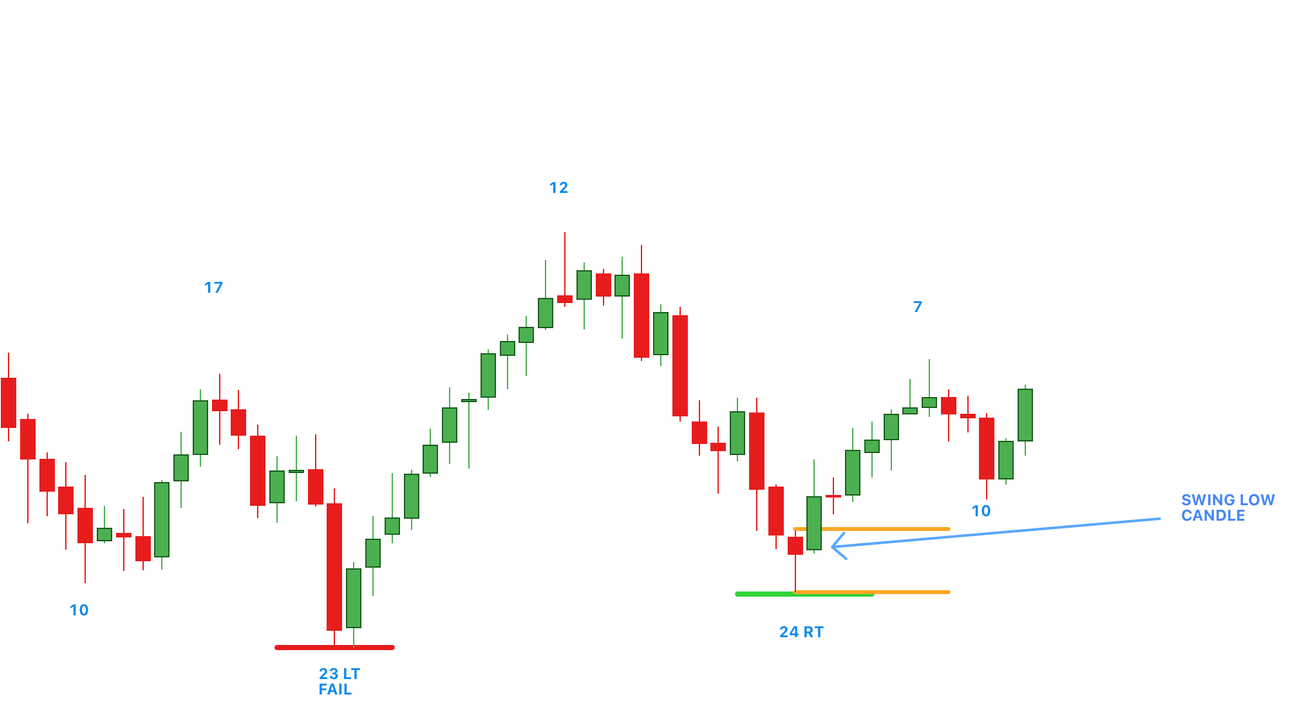

Swing Low

Definition: A swing low is established when the price falls to a new low within a certain period and then rises above the high of the candle on which the low occurred. This indicates a potential reversal or bounce from that low.

In the outlined example, the swing low was confirmed when the price close above the high of the 'low' candle. It's very typical for the swing low to be printed right following the low candle. The cycle low candle is marked with orange horizontal lines in the outlined example

Why do we care about swing high and swing low

Cycle swings are very important as it gives us an early indication of a trend change & a possible cycle low.

Criteria to confirm cycle low:

- Swing Low

- Price close above 10 moving average

- Price close above cycle declining trendline

Cycle Swings & Different Timeframes

Concept of cycle swings applies to all timeframes. As we work alongside multiple timeframes, each swing will give us clues on the magnitude of the cycles

Daily Swing - Daily cycle

Weekly Swing - Intermediate (weekly) cycle

Monthly Swing - Yearly cycle