Cycles Translation

What is Cycle Translation?

A cycle is identified by the two low points in price that are situated around a central peak of the cycle.

Translation in cycle analysis refers to the timing of the peak within a given cycle. If the peak occurs to the right of the cycle’s midpoint, it is known as a right-translated cycle. Conversely, if the peak appears to the left of the midpoint, it is identified as a left-translated cycle.

Cycle translation is a critical concept in financial market analysis that helps traders and investors gauge the overall market trend. By identifying the position of the peak within a cycle relative to its midpoint, one can discern whether the market is in a bullish or bearish phase.

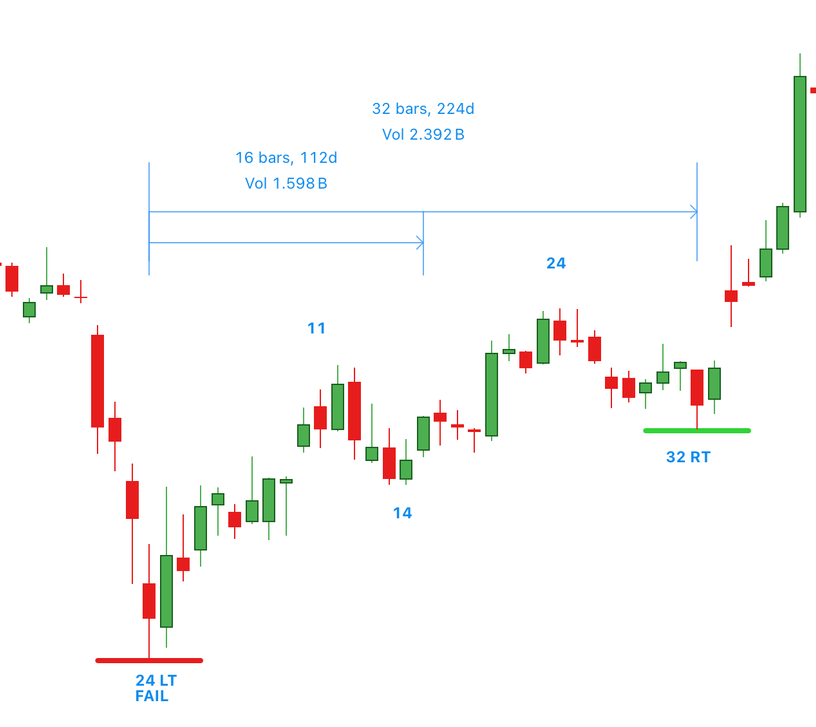

Right Translated Cycle (RT)

Right-translated cycles are characterized by their peaks occurring after the midpoint of the cycle. This positioning suggests that the cycle spends a greater portion of its duration in an upward trajectory and less time declining. Typically, right-translated cycles are indicative of a bullish trend, characterized by a pattern of higher highs and higher lows

For the RT cycle example, the duration of the cycle was 32 weeks. The cycle midpoint was 16 weeks & the actual cycle high was printed on week 24. As week 24 is to the right of the cycle midpoint, this cycle is Right-Translated and marked RT on the chart

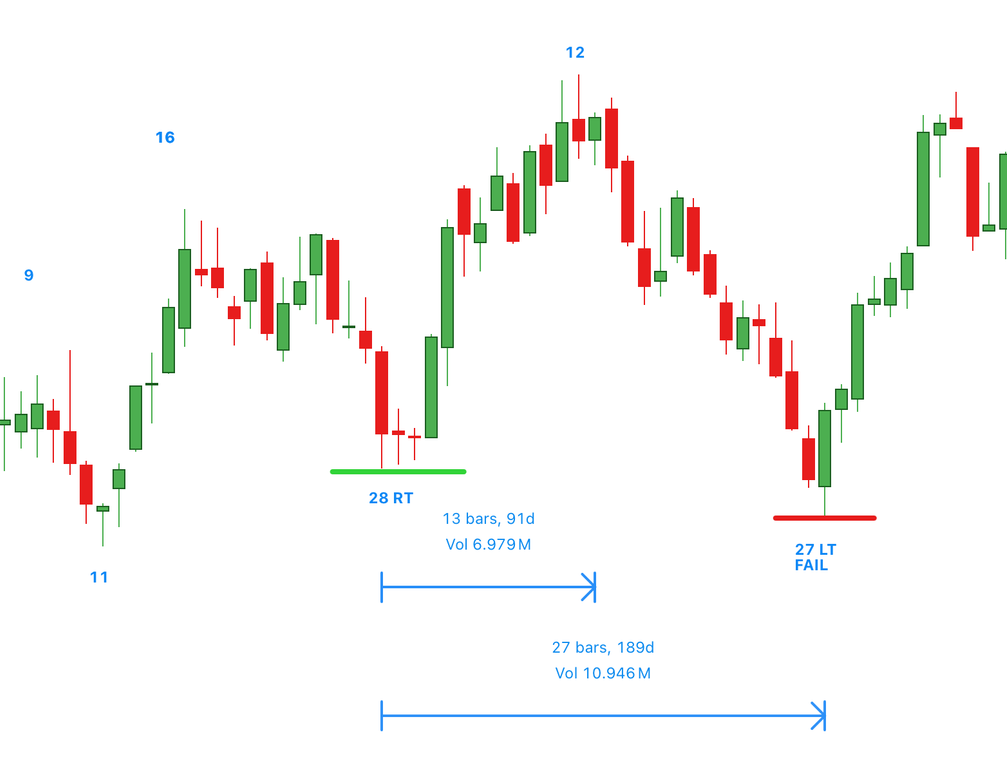

Left Translated Cycle (LT)

Left-translated cycles feature peaks that occur before reaching the midpoint of the cycle. This early peaking implies that the cycle spends a larger portion of its duration in a downward trajectory and less time rising. Generally, left-translated cycles suggest a bearish trend, marked by a sequence of lower highs and lower lows

In LT cycle example, the duration of the cycle was 27 weeks. The cycle midpoint was 13 weeks & the actual cycle high was printed on week 12. As week 12 is to the left of the cycle midpoint of 13 weeks, this cycle is Left-Translated and is marked LT on this chart.

Strategic Implications of Cycle Translation

Understanding whether a cycle is right or left-translated can profoundly affect your personal investment and trading decisions. Knowing the cycle's translation helps you pinpoint the optimal moments to enter or exit the market, enhancing your potential for success.

Investing During Right-Translated Cycles

In right-translated cycles, where the peak comes after the midpoint, the market exhibits strong upward momentum. This phase is often the best time to buy or increase holdings, as the extended upward movement suggests that the market could continue to climb. Investing during the early or middle stages of a right-translated cycle can position you to take full advantage of growth opportunities before the cycle reaches its peak.

Capitalizing on Left-Translated Cycles

Conversely, left-translated cycles indicate that the peak occurs earlier, and the market spends more time in decline. This scenario provides a clear signal for potential exit strategies or for considering short-selling tactics. If you're already holding positions when a cycle is identified as left-translated, it might be prudent to start securing profits or reducing exposure before the downward trend intensifies.

Making Informed Decisions

By recognizing and understanding these cyclical patterns, you can make more informed decisions about when to buy, hold, or sell. This strategic approach not only helps in safeguarding your investments but also in identifying high-potential opportunities to maximize returns. Cycle translations offer a lens through which you can view the market's rhythmic fluctuations, turning these insights into actionable strategies that align with your financial goals.