Four-Hour Cycle Low Report

June 12, 2024 (week 24)

For Black Belt Tier Subscribers

It's been a big week for the markets, and it's only Wednesday. The BOC and ECB have decided to lower their rates, while the FOMC has maintained the current interest rates.

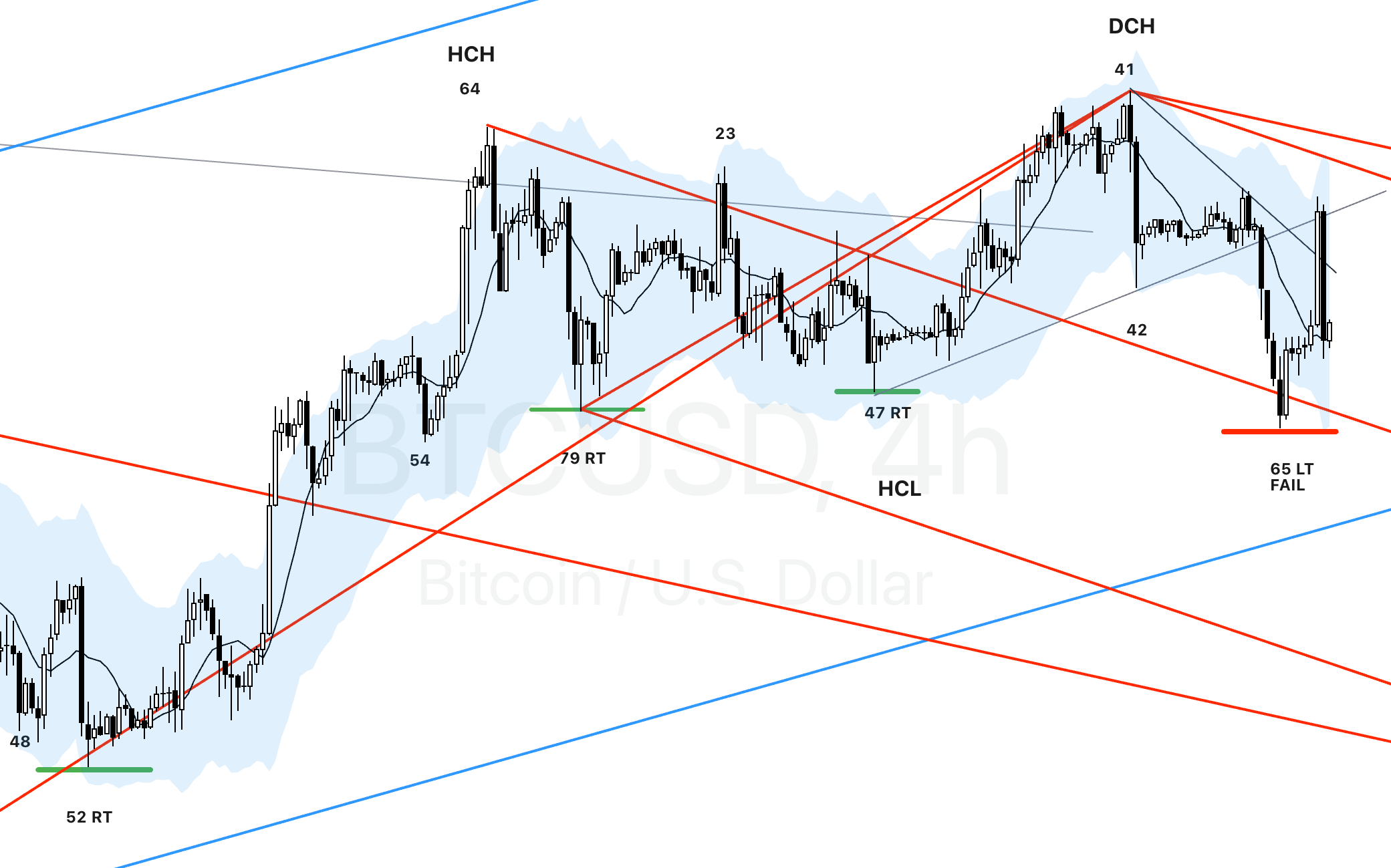

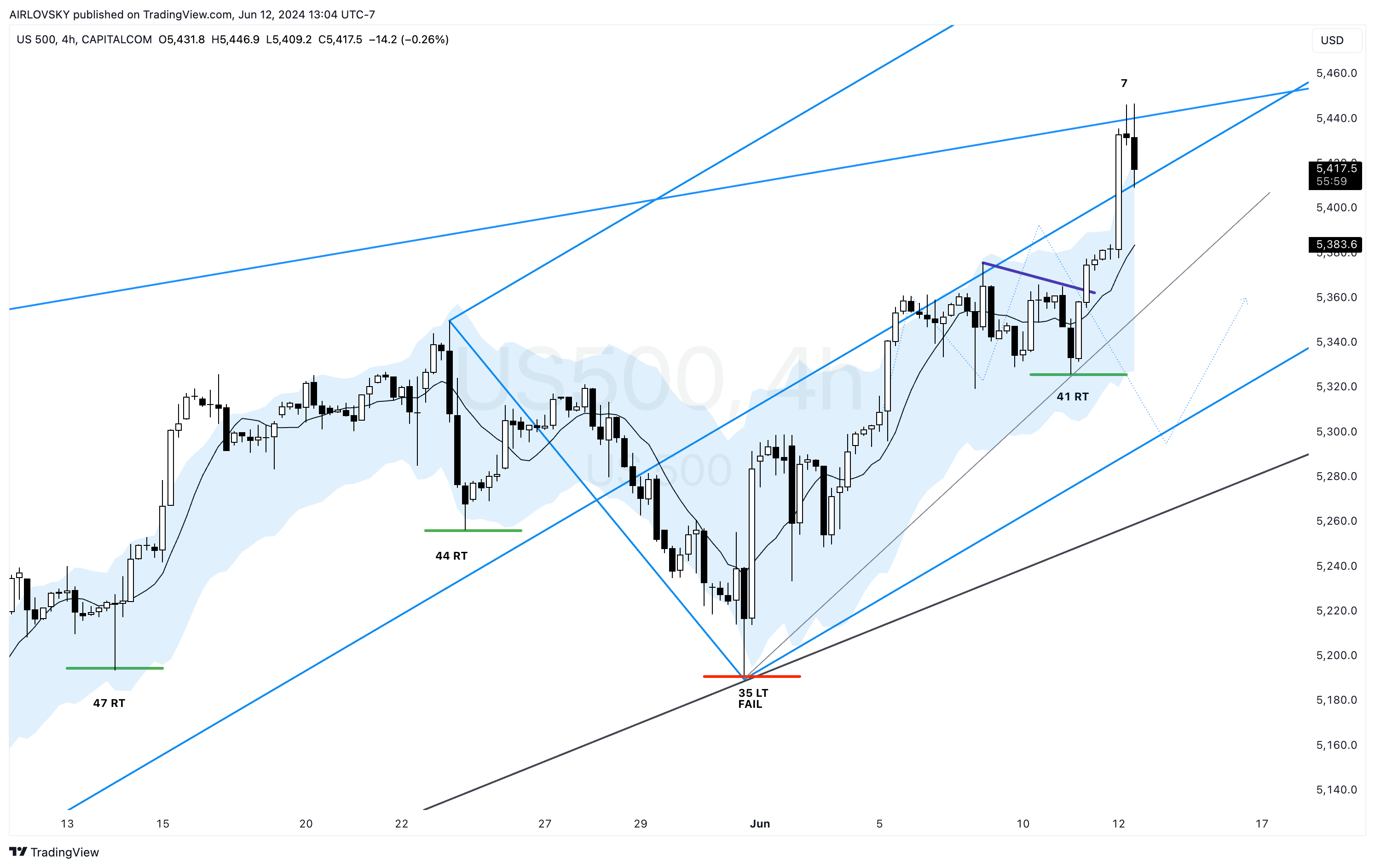

Markets pushed higher prior to FOMC, confirming the lows for $US500, $BTC, and $EURUSD. After the meeting, the prices have printed a swing high and started backtesting cycle lows. Let's break down 4HR cycles below to give us a clue on the next move!

$US500 - Four-Hour Cycle Overview

Current Cycle Position:

- Early 4HR cycle low confirmed on bar 41 in RT cycle. We have subsequently pushed higher to a swing high on bar 7 (HCH) in time for the FOMC meeting.

- I expect bar 7 to be HCH, and we are now starting to move down to HCL around June 18 (early next week). This will be confirmed if the backtest expends past 12 bars on 4HR cycle.

- As noted in prior posts, there is a chance June low was an early DCL. Upcoming 4HR HCL placement will be key in determining if this was in fact DCL. More on that on the weekly cycle report.

Cycle Count:

Key Insights: