Weekly Cycle Report - Week 21, 2024

Welcome to the Weekly Cycle Report for Week 21 of 2024 (May 18, 2024). In this newsletter, we'll dive into the current cycle positions and expected moves for a variety of asset classes, including currencies, bonds, commodities, and stocks. We aim to provide you with valuable cycle insights to help you pin down time.

Brief Market Overview

If you have been following along from the previous X feed, you should have noticed the emphasis on mid-May where we were expecting a major cycle turn date for most asset classes. Cycle lows printed across the markets after a monthly swing high from early to mid-May.

We are now moving higher post-cyclical lows - looking for YCH prints and presenting us with opportunities for cyclical bottoms ahead.

Currencies:

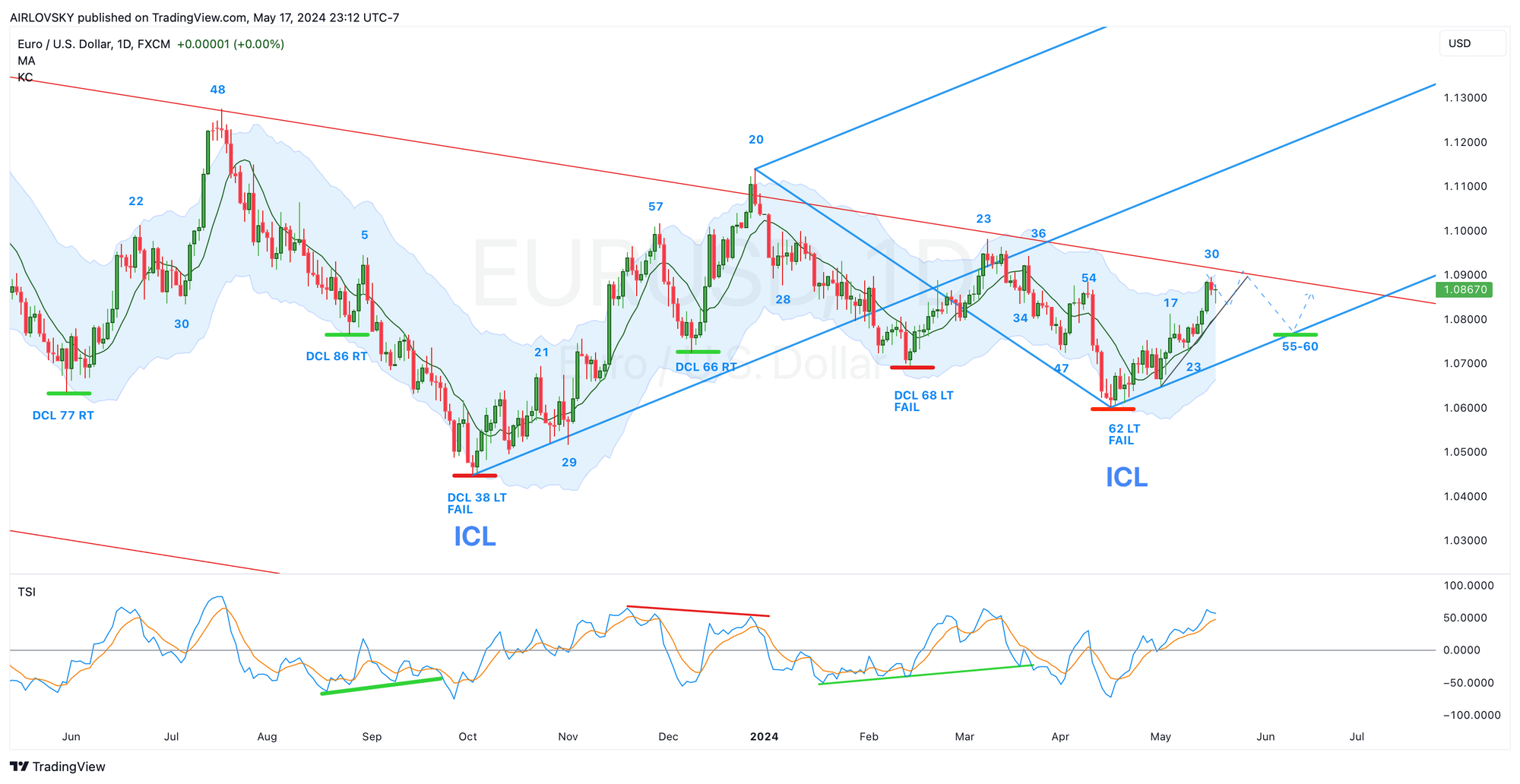

$EURUSD

Daily Chart Analysis:

- Holding on to the trendline as it's looking to print a definitive RT cycle. As ICL is already behind us, RT cycle is expected based on my analysis, but I'm still expecting resistance from the red bear fork ahead.

- Outlined the timing path for the cycle and possible areas of support and resistance. Please note, that these are only timing arrows for DCL.

Weekly Chart Analysis:

- Bounced from expected ICL but finished with a LT weekly cycle indicating the next weekly cycle has a stronger probability of failure. Upcoming DCL placement will be key to give us a clue on the next move.

- Based on the current assessment, we expect a failed weekly cycle declining into YCL ~ October 2024.