Weekly Cycle Report - Week 23, 2024

Welcome back to the Weekly Cycle Report for Week 23 of 2024. This week, we'll update you on the markets as we might have seen a few HCL prints. We've also got our eyes on a monthly swing high for $USOIL.

Key Highlights

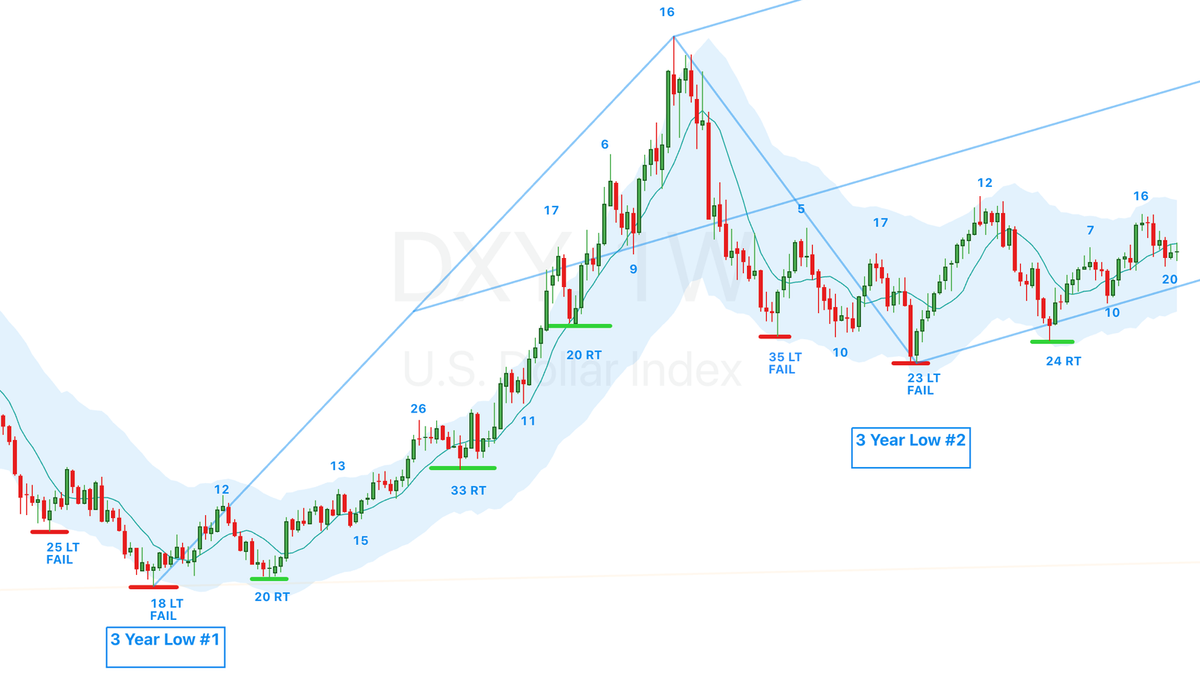

- $USD: Continuing decline to ICL.

- $TNX: Looking flat, expecting ICL decline.

- $Gold, $Silver, $Copper: Likely HCL prints - no confirmation yet.

- $USOIL, $Copper: Monthly swing high.

- $QQQ: Weekly swing high.

Brief Market Overview

Swing highs and declines to HCL were the themes across the markets. No clear indication if HCL has been printed yet, one exception - $TLT, with the rest we'll find out next week. A significant monthly swing high in $USOIL has raised concerns about the potential failure of the yearly cycle. There is some uncertainty for $EURUSD and $DXY as one printed a daily swing low while the other is currently backtesting its DCL.

Now, let's dive into the detailed analysis with the charts below.

Currencies:

$EURUSD

Daily Chart Analysis

- Swing low and a close above 10MA for $EURUSD, potentially signalling an early DCL.

- The cycle low will be confirmed with a break above the daily declining trendline (black line). We will know early next week if the cycle decline continues or if an early DCL was printed.

- Day 44 would be quite early for DCL for $EURUSD; the current expectation is still a continued decline to days 55-60, aligning with the 4-hour cycle low decline.